Finest Small Enterprise Loans

Disclosure: This content is endorsed by the reader. So if you click on some of our links we may receive a commission.

Unless you are independently wealthy, most small business owners will need a loan at one point or another. From paying start-up costs to expanding projects, equipment, or unexpected incidents, having quick access to finance makes it easy for your business to grow.

Whether you're starting a brand new business or owning an established business, there are so many different small business loan options out there.

Which Small Business Loan Is Best For You? This guide has everything you need to know about the subject.

The Top 6 Options For Small Business Loans

- Lost and found box

- Financing group

- Accion

- Lendio

- OnDeck

- Kiva

How To Choose The Best Small Business Loans For You

Small business loans come in different shapes and sizes. There are certain considerations that need to be considered when evaluating different options. I will explain each one in more detail below.

Lender

When most people think about a loan, they automatically assume that a bank is their only option. In addition to small local banks and national bank chains, there are many other lenders who can provide capital to your small business.

You can explore credit unions, crowdfunding sites, P2P lenders, loan marketplaces, nonprofit lenders, and even alternative loan solutions.

The qualification requirements and loan terms vary from lender to lender.

Loan type

Most lenders offer several types of small business loan. Some common types of small business loans include SBA loans, lines of credit, installment loans, short term loans, equipment loans, commercial real estate loans, and cash advances from merchants.

In some cases, you will need to provide the lender with more information about what you will be doing with the funds. For example, an equipment loan could not be used to purchase inventory, and a commercial real estate loan could not be used to purchase a new vehicle.

Lines of credit are great options as they can be used for many different purposes. We'll go into more detail about these different loan types shortly.

Required capital

The desired loan amount must also be considered. There's a big difference between $ 5,000, $ 50,000, and $ 5 million.

Certain lenders are better suited to microloans and small amounts, while others are known to lend large sums of money.

Before you apply for a loan, find out about the minimum and maximum amounts available. In general, you shouldn't apply for more than you need (unless it is a line of credit). Otherwise, you will receive higher interest payments.

Minimum qualifications

In most cases, you will not qualify for every type of loan. Therefore, pay close attention to these conditions before you apply. Otherwise, you will be wasting your time (and potentially affecting your bankroll).

Some lenders only loan money to companies that have been in business for a certain number of years. There are also some cash flow requirements, annual turnover requirements, and business owner credit requirements for specific loans.

Loan terms

The loan terms are crucial when considering various options. How soon do you have to repay the money? What interest rates do you pay?

Make sure you look beyond the dollar amount and take a closer look at the terms.

Companies with bad credit do not have access to the lowest interest rates and credit terms. So, be sure to shop around until you are comfortable with the options on offer.

The different types of small loans

There are tons of different small business loans out there. However, I want to quickly highlight the most popular options to give you a better understanding of how they work.

SBA loan

SBA loans are secured by the Small Business Administration. This federal agency helps businesses get access to better funding.

These loan amounts typically range from $ 50,000 to $ 5 million with a term of 10 to 25 years.

SBA loans usually have high interest rates (because the SBA reduces the lender's risk), but they can be difficult to qualify. The process of applying and approving an SBA loan can be slow.

Credit line

Lines of credit are great for those of you who need flexibility. Instead of receiving a lump sum in cash, you can borrow up to your loan amount if necessary.

Business lines of credit can range from $ 1,000 to $ 500,000.

It is usually easy to qualify for a line of credit if you've been in business for more than a year and have annual sales in excess of $ 50,000. Interest rates vary depending on the lender, creditworthiness, and other qualification requirements. However, you only pay interest on the amount you borrow on the revolving line.

Term loan

Forward loans are funded quickly. In some cases, you can receive cash within 24 hours of approval. It is common for term loans to be used for working capital, equipment, operations, and more.

Some of these loans are short term and have to be paid back in as little as 12 to 24 weeks. Others have repayment terms ranging from 1 to 5 years.

Forward loans usually have fixed rates or flat fees, so your payments do not increase over the life of the loan.

Merchant Cash Advance

With a merchant prepayment program, small businesses can borrow against future earrings to help secure capital. These loans are repaid using a daily percentage of your credit card sales as previously agreed with the lender.

Most merchant cash advances can be used for a variety of needs. Much like a fixed-term loan, you can usually also access funds quickly.

Getting a dealer cash advance approval is easy, but the interest rates are usually high.

Equipment financing

The name is pretty self-explanatory here – the money from the equipment finance must be used to buy equipment. It is worth noting, however, that the term "equipment" is fairly broad.

In addition to conveyor belts, forklifts, and machines, other types of equipment such as accounting software or payment processing systems also fall into this category.

Equipment funding is usually provided by the equipment you purchase. If you fail to repay the loan, the lender may confiscate the equipment.

Business credit card

Credit cards and loans are obviously not the same thing. However, a business credit card can potentially be a good option to fund certain purchases.

Some cards offer company introductory promotions such as 0% APR funding within the first year of account opening. So you can potentially buy something at 0% interest by putting it on your new credit card (assuming it is less than your loan amount). Beyond the introductory offer, however, credit cards will have significantly higher interest rates than other types of loans.

You can read my reviews of the best business credit cards here.

Secured Loans

A secured loan requires collateral in order for you to qualify. This is common in high-risk companies. If the company defaults on the loan, the lender will confiscate the collateral.

Since secured loans are not that big a risk for lenders, the interest rates are usually low.

Unsecured Loans

An unsecured loan is the complete opposite of a secured loan. Companies can borrow money without having to provide collateral.

Typically, to qualify for an unsecured loan, your business must have a long track record of profitability and success with no mortgage liens or outstanding debt. If the lender believes that you have a high risk of default on the loan, you may need to secure the loan with collateral.

Crowdfunding loans and P2P lending

These types of loans are drawn from a pool of investors. You can get these loans from crowdfunding websites with small amounts raised by the public, or from alternative lending platforms where individuals offer P2P loans as a source of income.

If you can't qualify for a traditional loan, you can consider a crowdfunding or P2P loan option.

# 1 – Fundbox Review – Best for Short Term Loans

Fundbox is used by more than 100,000 companies in a wide variety of industries.

Technically, they offer business credit lines. However, the repayment deadline for the amount you borrowed is repaid through a 12 or 24 week plan that falls under the short term loan category.

Fundbox is easy to use and you have quick access to cash at any time. To apply, all you need to do is connect your bank account and accounting software so Fundbox can display your financial details.

You only pay for funds that you draw from your line of credit, so you can use Fundbox multiple times for various short-term loans. There is no penalty for early repayments.

Before you withdraw any money, Fundbox will provide you with a transparent calculation of the principal, the interest amount and the weekly payments due. So you can plan accordingly and know exactly how much you owe each week for the duration of the loan.

Fundbox is perfect for short-term situations when you need a little more money. It is widely used for late bill payments, unplanned expenses, and for floating small businesses during times of slow sales.

Apply online and make a decision within minutes. Funds can be transferred to your account on the next working day.

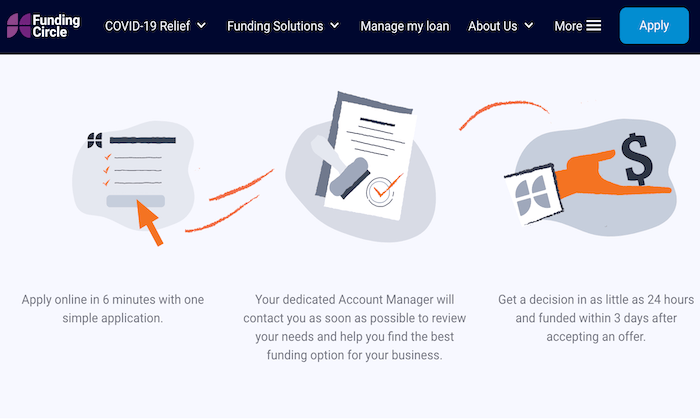

# 2 – Funding Circle Review – Most Versatile Loan Options

Funding Circle is an industry leader in the small business lending category. It's a popular choice for businesses that want quick and affordable loan options.

With a single application, Funding Circle gives you multiple loan types and options to choose from.

The loan types and financing solutions provided by this lender include:

- SBA loan

- Business loans

- Dealer cash advances

- Credit lines

- Invoice factoring

- Working capital loans

You can make a decision in less than 24 hours and get access to funds within three days of approval. Funding Circle has term loans of $ 25,000 to $ 500,000 and SBA loans of $ 20,000 to $ 5 million.

I also like Funding Circle because the platform makes it easy for you to manage your loan online. Apply on their website by completing an application. It only takes six minutes to fill out.

# 3 – Accion Review – Best for Startups

Accion is a non-profit organization that helps small business owners and entrepreneurs fund their startups.

In fact, Accion is the largest not-for-profit credit network in the United States.

Accion offers term loans of up to $ 250,000 at an affordable rate. You can apply online or by phone for a bespoke solution that fits your unique needs.

Here are some of the types of businesses that Accion typically borrows for:

- Women-owned company

- Minority-owned companies

- Food and beverage company

- Small businesses

- Startups

- Veteran company

- Entrepreneurs with disabilities

- Green companies

Accion also has a wide range of small business resources to help you succeed in your industry. With over 25 years of experience in small business lending, I recommend Accion Startups and other companies in the categories listed above.

# 4 – Lendio Review – Best Market Place for Small Business Loans

Lendio is not a small business lender. But it's one of the most popular online business loan marketplaces.

If you want to compare loan options from 75+ lenders using a single platform, Lendio is the place for you.

This marketplace has raised more than $ 10 billion in funding to more than 216,000 small businesses. A wide range of loan types are available through Lendio's lender network, including:

- Start-up loan

- Term loan

- Commercial mortgages

- Short term loans

- SBA loan

- Dealer cash advances

- Credit lines

- Business credit cards

- Equipment finance

- Accounts Receivable Financing

- Business acquisition loan

I also like Lendio because they provide additional resources for small business owners, such as: B. Financing calculator and accounting guidelines.

Simply fill out some brief information about your business online to receive loan offers from lenders on the Lendio network.

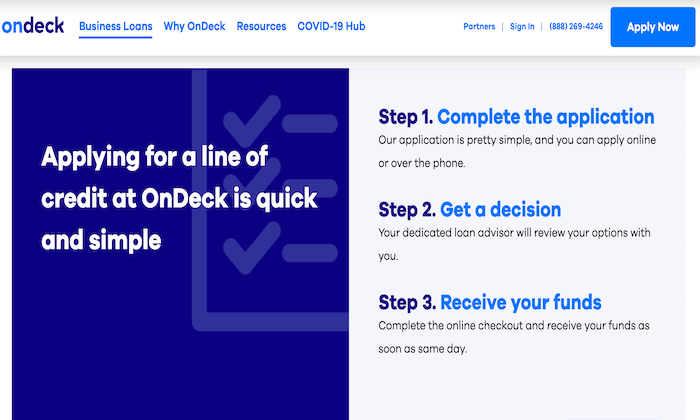

# 5 – OnDeck Review – The Best for Revolving Loans

OnDeck has delivered more than $ 13 billion to companies around the world. They offer term loans of up to $ 250,000 and business lines of credit of up to $ 100,000.

I like OnDeck because it's so easy. After you've completed an application online or over the phone, a dedicated credit counselor will discuss your options with you. OnDeck offers financing on the same working day.

Your OnDeck line of credit is a great working capital option. Withdraw only what you need when you need it and only pay interest on the amount borrowed.

Pay back your line of credit over a 12 month period with automatic weekly payments and no prepayment fees.

To qualify, you must have been in business for at least a year with a minimum personal FICO score of 600 and annual sales in excess of $ 100,000.

OnDeck regularly reviews your credit profile. This allows you to automatically qualify for higher credit line limits without having to apply for an increase. You also benefit from a consolidated weekly payment for all withdrawals, so you don't have to worry about multiple payments.

# 6 – Kiva Review – Best Small Business Loans with 0% Interest

If you need a microcredit and are in no rush, Kiva lets you borrow up to $ 15,000 at 0% interest – no strings attached.

As a global not for profit, Kiva has helped more than 2.5 million entrepreneurs raise more than $ 1 billion.

The only downside to kiva is that it takes quite a long time to actually complete the loan. As such, it's not ideal for businesses in need of cash fast.

First, you need to complete an online application, which can take up to 30 minutes to complete. Then you need to prove your creditworthiness by convincing your friends and family to loan you money. This takes about 15 days. Finally, you can get Kiva public and have your loan visible to 1.6 million lenders around the world (another 30 days).

On the positive side, you have up to 36 months to repay your loan with 0% interest. It's hard to hit that deal.

However, if you are looking for large sums of money as soon as possible, this is not the best choice for your business.

Summary

If your small business needs money, there are many different small business loan options that you can consider.

Which is the best?

The answer depends on a variety of factors such as the amount you need, the type of loan, the lender, and a lot more. Regardless of your situation, you can find the best loan options for your business based on my recommendations in this guide.